The Gantri Crane is standing as a container stack below in the Brani Terminal, which is operated on 12 April by PSA (Port of Singapore Authority) International PTE, Singapore. Photo Credit: Getty Images

TeaHe has been the greatest champion of the Chief architect of free trade and globalization from the mid -20th century. However, in a stunning reversal of roles, US President Donald Trump bombed a carpet of the global trade system on 2 April, which he declared as “Mukti Divas”.

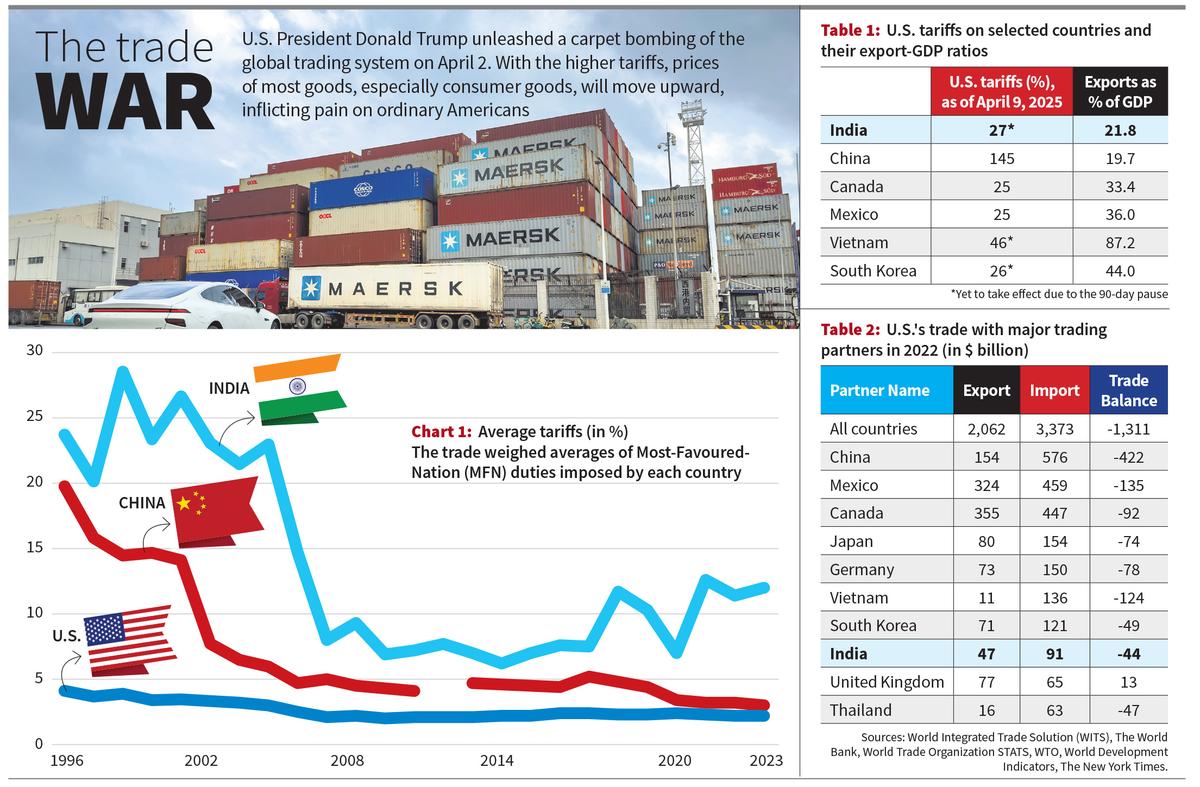

US tariffs, or tax, levy on imports from other countries, was 2 to 3% for two decades by 2024 (Chart 1). However, President Trump announced on 2 April that the US would charge a minimum 10% tariff fee on all its imports. The imports of about 60 countries will have a much higher level tariff-which is being described as “mutual” tariffs. These include 20% on the European Union (EU), 27% on India and 46% on Vietnam.

In February, 25% tariffs were installed in Mexico and Canada, US neighbor and its two biggest trading partners. But the biggest shock has been tariffs on China, which supplies a six-six of all foreign goods in America. By April 11, imports from China to America will now face 145% (Table 1) tariff.

Markets recurred with horror on the scale of increasing tariffs and their uncertainty. The stock markets nose. China has retaliated, returning each tariff shock equally. It has imposed 125% tariffs on imports from the US, a different possibility that the US and the world are moving towards a painful economic recession. On 9 April, President Trump reversed some of his decisions, announcing a 90-day stagnation on the “mutual” tariff for most countries, saying that the tariffs standing on China would have immediate effect.

If the tariffs were 3%, the US market would have been imported from a commodity (Vietnam) with a price tag of $ 100 (Vietnam). However, the same good should be purchased for $ 146 when newly declared tariffs are effective. Tariffs protect domestic industries from foreign competition but the price may increase.

‘Make America Great Again’

With its high per capita income and low tariffs, the US has been the largest export market for goods from cars to computers, supporting manufacturing jobs in many countries. In 2022, China exported goods worth $ 576 billion to the US, but in turn, China could sell only $ 154 billion goods (Table 2). Overall, the US had a 5% trade deficit of $ 1,311 billion in 2022, or its GDP (GDP). The US has managed to continue buying more than the world, which sells as a major international currency due to the dollar condition. This is mainly thanks to China, which continues the property of the dollar-sect, storing the important part of its large export surpluses into the American Treasury Bond. Such mutually beneficial relations between the two largest economic powers have been the major driver of the globalization of trade and finance since the 2000s.

However, globalization creates inequalities not only in developing but also in developed world. In the US, sector imports such as steel and automobiles have been the biggest hits.

The displeasure of the workers in these areas-many of whom are white, middle-aged men-have been one of the factors who have helped to pursue Mr. Trump for the post of US President in 2016 and then in 2024. President Trump has promised to revive American manufacturing, which in the first years, allowed the US to rip with his imports.

Without a doubt, President Trump is playing with fire. With high tariffs, the prices of most items, especially consumer goods, will move upwards, increasing pain on common Americans. It is suspected that American firm imports can make a part of the demand made for them by making them expensive and can take up their production capabilities to serve at least.

Chinese gambling

China has vowed to “fight up to the end” which may be a long and bitter trade war. Such Bravo is supported by the fact that China has been silently preparing for such a performance for more than a decade, gradually reducing its dependence on the American economy. The ratio of export to GDP has come down from 35% in 2012 to 19.7% in 2023. As a ratio of its total exports, the US has also fallen in China’s exports, from 21% to 16.2% in 2022 in 2006. China has invested especially in Artificial Intelligence in Science, Technology and Innovation. This has been partially done in response to the US sanctions on technology transfer in China. China shifted the first American tariff by transferring production to its East Asian neighbors (especially Vietnam), with which it created a deep economic network.

India’s options

President Trump called India a ‘Tariff King’, referring to India’s remarkable increase in tariffs since 2018 (Chart 1). The largest part of India’s exports is sold to the US ($ 91 billion in 2022), and they are important to meet the country’s large import bills. Therefore, after the tariff hike, any reduction in India’s export income will be eagerly felt. At the same time, since exports forms a relatively small part (21.8%) of its GDP, tariff growth may be lower than many other countries (Table 1) in India. Apart from this, there is no increase in tariffs on pharmaceuticals and services, two major export items of India America

The narrowness of its manufacturing capabilities is the biggest obstacle for India. Tariff protection and production linked incentive scheme is not enough to revive the sector. India requires a clear-cut industrial policy and revival in investment to invest to avoid global upheaval.

Jayan Jose Thomas is a professor of economics at the Indian Institute of Technology (IIT) Delhi.

Published – April 14, 2025 08:30 AM IST